See:

(Text)

Freedom Law School Tax Evader Gets Prison Sentence

By Robert W. Wood – November 11, 2016

The right to protest may be fundamental, but tax protesters are sometimes treated differently than others. You can be called a lot of things, but in the tax world, you do not want to be called a tax protester or tax denier. Despite free speech protections, some arguments about taxes seem almost as incendiary as yelling ‘fire’ in a crowded theater.

Tax protesters or tax deniers generally voice arguments that are so extreme the IRS puts them in a special category. In IRS lingo, “frivolous” is also bad, just shy of the other “f” word, “fraudulent.” Using these F words can get expensive, and possibly even involve jail time. Remember Wesley Snipes?

Richard Thomas Grant, 63, of Point Richmond, California, was found guilty of three counts of tax evasion following a jury trial. And he has now been sentenced to 33 months in prison. In 2001, Grant stopped filing individual income tax returns and paying income taxes.

But he was collecting significant income as a partner with Grant Engineering & Manufacturing, an engineering company in Richmond, California. In 2003, Grant stopped filing annual partnership returns for Grant Engineering, even though he continued to pay a CPA to prepare them. That same year, Grant became a member of Freedom Law School and paid thousands of dollars in yearly membership fees.

The IRS attempted to collect Grant’s unpaid taxes for 2001 and 2002, and attempted to examine Grant’s taxes for subsequent years. But Grant, with help from Freedom Law School and its founder, Peymon Mottahedeh, attempted to frustrate the IRS’s actions. Among other actions, they filed multiple lawsuits to tie up the IRS in multiple courts.

For 2005 through 2009, Grant’s partnership income was $509,339, $566,741, $486,062, $598,977 and $604,706, respectively. In an effort to conceal his assets and income, in 2005, Grant significantly curbed his use of checking accounts. Instead, he began depositing his partnership distributions at a warehouse bank known as MyICIS in Berryville, Arkansas.

Warehouse banks can conceal ownership of funds in part by commingling funds with those of other individuals. Between April 2005 and October 2006, Grant wrote hundreds of checks drawn on the MyICIS account and funded multiple prepaid debit cards. Grant used the checks and debit cards to pay his mortgage and other personal expenses.

After the feds shut down MyICIS, Grant used another bank to convert his partnership distributions to cashier’s checks and cash. That way, he avoided depositing the funds into a bank account. He used the cashier’s checks to pay his mortgage and other high-dollar personal expenses.

He also used cash to purchase dozens of U.S. Postal money orders to pay other bills and expenses. He paid his utilities, taxes and expenses related to his classic aircraft. In addition to 33 months in prison, Grant was ordered to serve three years of supervised release, and pay restitution to the IRS in the amount of $402,457.39.

In 1998, Congress prohibited the IRS from labeling individuals “illegal tax protesters.” Congress also ordered the IRS to purge the “protester” code from the computer files of 57,000 Americans. But lawmakers didn’t stop the IRS or the courts from imposing stiff penalties on those who make traditional protest arguments or take other positions that the IRS deems to be “frivolous.”

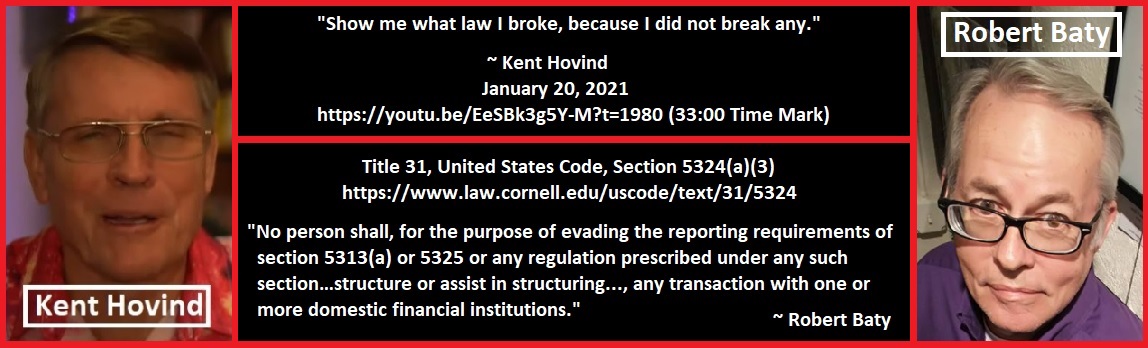

You can Google “Freedom Law School” and “Kent Hovind” and browse information which ties Kent and his people to the School.

Here’s one such link:

https://www.facebook.com/HovindvBaty/posts/299650950427718

(Begin quote.)

Rudy and Erin Davis further demonstrate that they are inclined to being ordinary tax-cheatin’ sorts like their hero Kent Hovind!

https://www.facebook.com/erin.imagine/posts/10157503636320357?pnref=story (Begin quote.)

Anyone interested in making a few bucks?

Karl P. Koenigs

Freedom Law School is offering $100,000 to the first person who can demonstrate any of the three propositions listed below. The winner can collect up to $300,000 if he or she can prove all of the propositions below.

1. Show what statute written by the Congress of the United States that requiring Americans to file an income tax “CONFESSION” (return) and pay an income tax.

2. Show how Americans can file an income tax “CONFESSION” (return) without giving up their 5th amendment right to not give any information to the government that may be used to prosecute them.

3. Prove that the 16th amendment to the United States Constitution, which, according to the IRS and modern American courts permitted the income tax to exist was lawfully added to the United States Constitution.

Freedom Law School declares:

There is no statute that makes any American Citizen who works and lives in the United States of America liable or responsible to pay an income tax.

Individuals only become liable to pay the income tax when they “VOLUNTARILY” file a tax return and the IRS follows their assessment procedures as outlined in the Internal Revenue Code.

If there were a statute, which clearly and unequivocally required the filing of such tax returns, such a statute would be unconstitutional under the present income tax system to the extent that it would require individuals to give the government information which could be used against them to prosecute them criminally.

Although the IRS and the modern American courts claim that the 16th Amendment of the U.S. Constitution permitted the income tax to be imposed on the compensation for labor of the average working man, the 16th Amendment was not properly added to the United States Constitution.

See www.thelawthatneverwas.com

for documentation of this issue.

The IRS, under the United States Constitution, cannot legally require information on 1040 returns from individuals.

This is the reason the IRS continually refers to the income tax as “voluntary.”

For more information, you may want to investigate the resources listed below:

http://www.freedomabovefortune.com

This is the site of Joe Banister, the former gun-carrying IRS Criminal Investigation Agent, who resigned from his prestigious job with the IRS because his superiors would not answer his findings of fraud within the IRS. (See this page.)

Mr. Banister’s report on the IRS confirms our opinions about the Federal Income Tax in great detail.

Bob Schulz, founder of We The People Foundation, has attempted several times with Joe Banister and many other intelligent Americans, to debate the legality of the income tax system with high ranking government officials.

Each time, no government official ever showed up to debate!

Any intelligent American would think the government would be more than happy to show up and answer a few questions to set the record straight once and for all, wouldn’t you…?

Or does the government have something to hide…?

Do your own research and decide if the government is hiding something.

See this page.

Also see the DVD “America Freedom to Fascism” at

http://www.freedomtofascism.com.

Peymon Mottahedeh

President – Freedom Law School

(813) 444-4800 | http://www.livefreenow.org

(End quote.)

(End quote.)

Comments

Freedom Law School Tax Cheat Gets Prison Sentence — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>