Watch for Updates

Originally Posted June 22, 2016

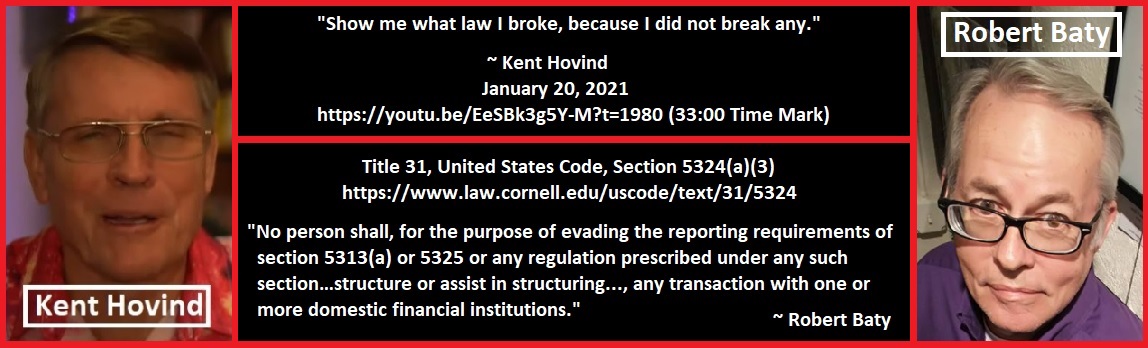

By Robert Baty

.

Kent Hovind lies when he claims he did not commit the crime of structuring and that the crime of structuring requires 2 or more transactions, each of $10,000 or less, in one day, that total more than $10,000. These lies have been a fundamental claim in Kent’s false legal narrative and many of his followers have promoted the same lies on behalf of Kent Hovind.

.

Kent Hovind 2006 Indictment

.

https://www.dropbox.com/s/4jvc8nkzbgnbcfe/002%20Hovind2006%2007112006.pdf

or

.

Title 31, United States Code, Section 5324(a)(3)

.

https://www.law.cornell.edu/uscode/text/31/5324

.

(excerpts)

.

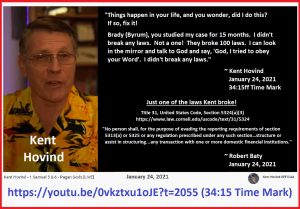

No person shall, for the purpose of evading the reporting requirements of section 5313(a) or 5325 or any regulation prescribed under any such section…structure or assist in structuring, or attempt to structure or assist in structuring, any transaction with one or more domestic financial institutions.

.

Title 31, United States Code, Section 5313

.

https://www.law.cornell.edu/uscode/text/31/5313

.

(excerpts)

.

When a domestic financial institution is involved in a transaction…of United States coins or currency… in an amount, denomination, or amount and denomination, or under circumstances the Secretary prescribes by regulation, the institution…shall file a report on the transaction at the time and in the way the Secretary prescribes.

.

Title 31, Code of Federal Regulations, Section 103.11(gg)

.

.

(excerpts)

.

…a person structures a transaction if that person, acting alone, or in conjunction with, or on behalf of, other persons, conducts or attempts to conduct one or more transactions in currency, in any amount, at one or more financial institutions, on one or more days, in any manner, for the purpose of evading the reporting requirements…

.

“In any manner” includes, but is not limited to, the breaking down of a single sum of currency exceeding $10,000 into smaller sums, including sums at or below $10,000, or the conduct of a transaction, or series of currency transactions, including transactions at or below $10,000.

.

The transaction or transactions need not exceed the $10,000 reporting threshold at any single financial institution on any single day in order to constitute structuring within the meaning of this definition.

.

COMMENTARY by Robert Baty

.

It is not disputed that Kent knew of the bank reporting requirement and that he knowingly and deliberately designed the singular withdrawals at issue to be less that $10,000 so as to keep from triggering the requirement that the bank file a cash transaction report.

.

In effect, Kent’s own factual admissions are sufficient to find that he was guilty of structuring in violation of the law and regulations.

.

As noted in the references above, structuring can include one transaction, on one day, in an amount less than $10,000. The transaction need not exceed the $10,000 threshold at any single financial institution on any single day.

.

By his own admissions, Kent Hovind was guilty as charged, but he has yet to admit to it.

.

Kent’s disingenuous defense has been to deny the clear reading of the law and applicable regulations and claim that structuring requires 2 or more transactions of less than $10,000 in a single day that total over $10,000. Kent Hovind has provided “NOTHING” to support such a claim and, as shown above, such claim can be reasonably shown to simply be false.

.

Update October 31, 2019

.

Link to on-line copy of current Form 104 (Cash Reporting) and instructions:

.

https://www.irs.gov/pub/irs-tege/fin104_ctr.pdf

(excerpt)

General Instructions

.

Who Must File.

.

Each financial institution (other than a

casino, which instead must file FinCEN Form 103, and the

U.S. Postal Service for which there are separate rules) must

file FinCEN Form 104 (CTR) for each deposit, withdrawal,

exchange of currency, or other payment or transfer, by,

through, or to the financial institution which involves a

transaction in currency of more than $10,000.

.

Multiple transactions must be treated as a single transaction if the

financial institution has knowledge that (1) they are by or

on behalf of the same person, and (2) they result in either

currency received (Cash In) or currency disbursed (Cash

Out) by the financial institution totaling more than $10,000

during any one business day.

.

For a bank, a business day is the day on which transactions

are routinely posted to customers’ accounts, as normally

communicated to depository customers. For all other financial

institutions, a business day is a calendar day.

.

Related article on this site added in October 2019:

http://kehvrlb.com/hovind-v-baty-the-voice-america-debate

.

Update November 2, 2019

Current regulation regarding reporting by banks as to daily aggregated amounts totaling over $10,000.00:

Code of Federal Regulations Section 103.22(a) & (b) & (c)(2)

(excerpts)

.

Update March 27, 2020

After the Hovind case was decided and affirmed on appeal, the Lang case was decided which raised questions about whether the Lang decision could be used for purposes of overturning Hovind’s “structuring” convictions. I don’t think so. I think the 2 cases are distinguishable sufficiently that Hovind’s convictions could withstand scrutiny in light of Lang. Both cases were decided by the 11th Circuit Court of Appeals.

Link to Hovind Appeal – Convictions Affirmed

Hovind Appeal on Structuring Issue

.

Link to Lang Appeal – Convictions Overturned

Lang Appeal on Structuring Issue

.

Link to Forbes.com Lang Article by Peter J. Reilly

.

Link to Forbes.com Article on Hastert, Hovind & Lang

Update November 5, 2020

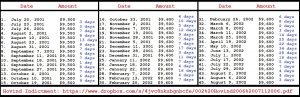

Following is my analysis of the 2006 indictment found at the following link; showing the charged structuring transactions and number of days between the transactions. Kent Hovind has most often claimed he withdrew the money every 2 weeks; not so according to my analysis. These are only the structuring transactions charged. The case indicates others could have been added but, due to prosecutorial discretion, they were limited to those 45 incidents.

https://www.dropbox.com/s/4jvc8nkzbgnbcfe/002%20Hovind2006%2007112006.pdf

Update January 21, 2021

https://youtu.be/EeSBk3g5Y-M?t=1980

Update January 24, 2021

https://youtu.be/0vkztxu1oJE?t=2055

Update July 16, 2022

2006 Kent Hovind Criminal Trial Transcript & Related Items

Kent Hovind 2006 Criminal Trial Transcript

https://pdfslide.net/documents/kent-hovinds-sentencing-transcript-01-19-07.html

Kent Hovind Sentencing Transcript (excerpts)

Jo Hovind Sentencing Transcript June 2007

Kent Hovind Tax Court Order and Decision

Kent Hovind Appeal of Tax Court Decision

.

A more complete analysis, as made by the IRS, is found at:

https://www.irs.gov/irm/part4/irm_04-026-013.html

—————————————————–

Matt Demello and I had an exchange regarding the law on structuring which can be found in the comments section at the following link:

http://kehvrlb.com/proposition-59-demello-v-baty-the-investigation

————————————————————