Originally Posted June 19, 2016

By Robert Baty

https://www.youtube.com/c/KentHovindOFFICIAL

https://www.facebook.com/groups/khwnprivate

Kent Hovind U.S. Tax Court Docket History

Kent Hovind Tax Court Docket Record

.

In 2013 Kent Hovind, through his surrogates, came to me requesting that we talk. It appears that that effort might have been because Kent was intending to try and influence and exploit the Forbes.com coverage I had been able to generate through Forbes contributor Peter J. Reilly. In any case, Kent and I had a brief exchange via his CorrLinks prison email account. It was terminated after it became clear Kent was not intending to have an open, honest conversation regarding his problems and false legal narrative. In the end, Kent simply terminated the connection and that was that.

.

One place that exchange is archived is on my YAHOO! discussion group site, which also has graphics of the email documents in its files which are available to members of that list. Here is the link to one posting there which provides the texts of the emails:

.

https://beta.groups.yahoo.com/neo/groups/Maury_and_Baty/conversations/messages/30893

.

Following are the texts as posted at that link (you might find it easier to read at the above link):

.

THE HOVIND-BATY EXCHANGE:

.

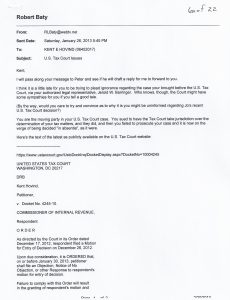

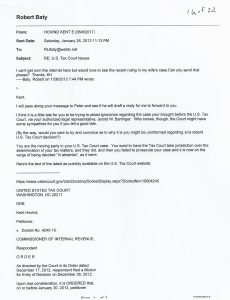

(1)

.

From: info@corrlinks.com

To: Robert Baty

Date: Sat, 26 Jan 2013 06:31:18 -0600

.

Subject: Inmate : HOVIND, KENT E

.

This is a system generated message informing you

that the above-named person is a federal prisoner

who seeks to add you to his/her contact list for

exchanging electronic messages.

.

You can ACCEPT this prisoner’s request or BLOCK

this individual or all federal prisoners from contacting

you via electronic messaging at www.corrlinks.com.

.

To register with CorrLinks you must enter the email

address that received this notice along with the

identification code below.

.

Email Address: xxxxxxxxxxxxxx

Identification Code: xxxxxxxxx

.

This identification code will expire in 10 days.

.

By approving electronic correspondence with federal

prisoners, you consent to have the Bureau of Prisons

staff monitor the content of all electronic messages

exchanged.

.

Once you have registered with CorrLinks and approved

the prisoner for correspondence, the prisoner will be

notified electronically.

.

For additional information related to this program, please

visit the http://www.bop.gov/inmate_programs/trulincs_faq.jsp FAQ page.

.

(2)

.

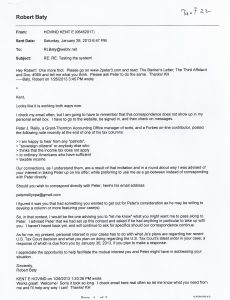

To: KENT E HOVIND 06452017

From: Robert Baty

Date/Time: 1/26/2013 9:28:56 AM

.

Subject: Testing the system

.

Kent,

.

I just thought I would try this out and see if the system

is working while I await your first message.

.

Sincerely,

Robert Baty

.

(3)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/26/2013 1:20:38 PM

.

Subject: RE: Testing the system!

.

Works great!

Welcome!

Sorry it took so long.

.

I check email here real often so let me know what

you need from me and I’ll help any way I can!

.

Thanks!

KH

.

(4)

.

From: Robert Baty

To: Kent Hovind

Date/Time: 1/26/2013 1:32:34 PM

.

Subject: RE: Testing the system!

.

Kent,

.

Looks like it is working both ways now.

.

I check my email often, but I am going to have to remember

that this correspondence does not show up in my personal

email box. I have to go to the website, be signed in, and

then check on messages.

.

Peter J. Reilly, a Grant-Thornton Accounting Office manager

of sorts, and a Forbes on-line contributor, posted the

following note recently at the end of one of his tax columns:

.

I am happy to hear from any “patriots”,

> “sovereign citizens” or anybody else who

> thinks that the income tax does not apply

> to ordinary Americans who have sufficient

> taxable income..

Our connections, as I understand the, are the result of that invitation

and in a round about way I was advised of your

interest in taking Peter up on his offer; while preferring

to use me as a go-between instead of corresponding with Peter directly.

.

Should you wish to correspond directly with Peter, here’s his

email address:

.

peterreillycpa@…

.

I figured it was you that had something you wanted to get out

for Peter’s consideration as he may be willing to develop a

column or more featuring your case(s).

.

So, in that context, I would be the one advising you to “let

me know” what you might want me to pass along to Peter.

.

I advised Peter that we had set up this contact and asked if

he had anything in particular to take up with you. I haven’t

heard back yet, and will continue to ask for specifics should

our correspondence continue.

.

As for me, my present, personal interest in your cases has to

do with what Jo’s plans are regarding her recent U.S. Tax Court

decision and what you plan on doing regarding the U.S. Tax Court’s

latest order in your case; a response of which is due from you by

January 30, 2013, if you plan to make a response.

.

I appreciate the opportunity to help facilitate the mutual

interest you and Peter might have in addressing your situation.

.

Sincerely,

Robert Baty

.

(5)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/26/2013 5:17:49 PM

.

Subject: Paul- please read my #4 and respond. Thanks! KH

.

Hmmm?

.

1.

.

There is a button someplace you can push to make the email

system notify you when one is waiting. Not sure how it works

but Ted can tell you I think.

.

2.

.

I’d like to see Peter define some terms first. I learned in the creation

evolutionism debate that defining terms is an essential first step.

What is his definition of patriot? income tax? income? etc. I have

always said that everyone should obey the law and pay any tax they

owe to the legitimate authorities. I do not consider myself a tax protestor

or a law breaker.

.

3.

.

I can only have 30 email contacts at a time and you are #30. I can’t

add Peter w/o dropping someone and with the legal battle and my book

projects and family I need the ones I have right now. I guess you can

be go-between if you don’t mind.

.

4.

.

I know nothing of Jo’s tax court decision nor did I know I have a deadline

to respond by Jan 30 to anything. They have not notified me of any of this.

I’ve not heard from “tax court” in several years. I think, in America, you get

to face your accusers and cannot be tried “in abstetia” or whatever the Latin

phrase is. Can you send me a copy of the “Tax Court’s latest order” you

reference please? I will cc this to Paul Hansen the ministry trustee since he

handles the legal stuff.

.

Thanks!

.

Kent Hovind

.

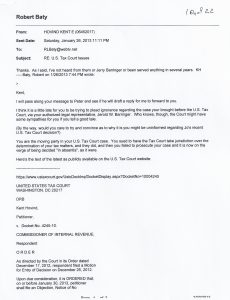

(6)

.

From: Robert Baty

To: Kent Hovind

Date/Time: 1/26/2013 5:45:05 PM

.

Subject: U.S. Tax Court Issues

.

Kent,

.

I will pass along your message to Peter and see if he will

draft a reply for me to forward to you.

.

I think it is a little late for you to be trying to plead ignorance

regarding the case your brought before the U.S. Tax Court,

via your authorized legal representative, Jerold W. Barringer.

Who knows, though, the Court might have some sympathies

for you if you tell a good tale.

.

(By the way, would you care to try and convince as to why it

is you might be uninformed regarding Jo’s recent U.S. Tax Court decision?)

.

You are the moving party in your U.S. Tax Court case. You sued to

have the Tax Court take jurisdiction over the determination of your

tax matters, and they did, and then you failed to prosecute your

case and it is now on the verge of being decided “in absentia”, as it were.

.

Here’s the text of the latest as publicly available on the U.S. Tax Court website:

.

https://www.ustaxcourt.gov/UstcDockInq/DocketDisplay.aspx?DocketNo=10004245

.

UNITED STATES TAX COURT

WASHINGTON, DC 20217

.

DRB

.

Kent Hovind,

.

Petitioner,

.

v. Docket No. 4245-10.

.

COMMISSIONER OF INTERNAL REVENUE,

.

Respondent

.

O R D E R

.

As directed by the Court in its Order dated

December 17, 2012, respondent filed a Motion

for Entry of Decision on December 26, 2012.

.

Upon due consideration, it is ORDERED that,

on or before January 30, 2013, petitioner

shall file an Objection, Notice of No

Objection, or other Response to respondent’s

motion for entry of decision.

.

Failure to comply with this Order will result

in the granting of respondent’s motion and

entry of decision sustaining the determinations

set forth in the notice of deficiency on which

this case is based.

.

(Signed) Michael B. Thornton

Chief Judge

Dated. Washington, D.C.

January 9, 2013

.

SERVED

.

(end Tax Court Order text)

.

I will be in touch later and consider other matters as I get time.

.

As much as I would like to continue to be directly involved, if you

decide the process would be more efficient by communicating directly

with Peter, I could give up my #30 spot and you could plug him in.

.

Just a thought.

.

Sincerely,

Robert Baty

.

(7)

.

From: KENT E HOVIND (06452017)

Date/Time: 1/26/2013 6:47:17 PM

.

Subject: RE: Testing the system!

.

Hey Robert!

.

One more thot.

.

Please go on www.2peter3.com and read:

.

> The Banker’s Letter;

> The Third Affidavit and

> Doc. #365.

and tell me what you think.

.

Please ask Peter to do the same.

.

Thanks!

KH

.

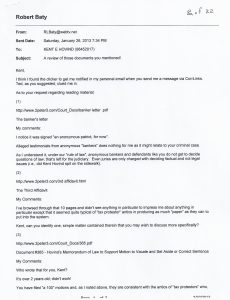

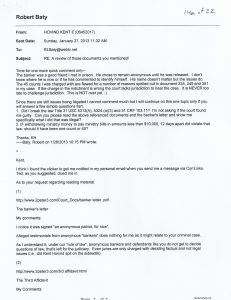

(8)

.

From: Robert Baty

To: Kent Hovind

Date/Time: 1/26/2013 7:34:03 PM

.

Subject: A review of those documents you mentioned!

.

Kent,

.

I think I found the clicker to get me notified in my personal

email when you send me a message via CorrLinks. Ted, as

you suggested, clued me in.

.

As to your request regarding reading material:

.

1.

.

http://www.2peter3.com/Court_Docs/banker letter .pdf

.

The banker’s letter

.

My comments:

.

I notice it was signed “an anonymous patriot, for now”.

.

Alleged testimonials from anonymous “bankers” does nothing

for me as it might relate to your criminal case.

.

As I understand it, under our “rule of law”, anonymous bankers

and defendants like you do not get to decide questions of law;

that’s left for the judiciary. Even juries are only charged with

deciding factual and not legal issues (i.e., did Kent Hovind spit

on the sidewalk).

.

2.

.

http://www.2peter3.com/3rd affidavit.html

.

The Third Affidavit

.

My Comments:

.

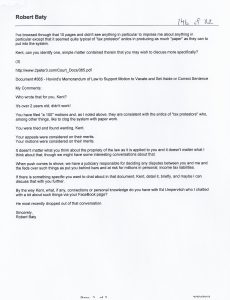

I’ve browsed through that 10 pages and didn’t see anything

in particular to impress me about anything in particular except

that it seemed quite typical of “tax protestor” antics in producing

as much “paper” as they can to put into the system.

.

Kent, can you identify one, simple matter contained therein that

you may wish to discuss more specifically?

.

3.

.

http://www.2peter3.com/Court_Docs/365.pdf

.

Document #365 – Hovind’s Memorandum of Law to Support Motion

to Vacate and Set Aside or Correct Sentence

.

My Comments:

.

Who wrote that for you, Kent?

.

It’s over 2 years old; didn’t work!

.

You have filed “a 100” motions and, as I noted above, they are

consistent with the antics of “tax protestors” who, among other

things, like to clog the system with paper work.

.

You were tried and found wanting, Kent.

.

Your appeals were considered on their merits.

Your motions were considered on their merits.

.

It doesn’t matter what you think about the propriety of the law

as it is applied to you and it doesn’t matter what I think about

that; though we might have some interesting conversations about

that.

.

When push comes to shove, we have a judiciary responsible for

deciding any disputes between you and me and the feds over

such things as put you behind bars and at risk for millions in

personal, income tax liabilities.

.

If there is something specific you want to chat about in that

document, Kent, detail it, briefly, and maybe I can discuss that

with you further.

.

By the way Kent, what, if any, connections or personal knowledge

do you have with Ed Umpervitch who I chatted with a bit about

such things via your FaceBook page?

.

He most recently dropped out of that conversation.

.

Sincerely,

Robert Baty

(9)

.

From: Robert Baty

To: Kent Hovind

Date/Time: 1/26/2013 9:17:12 PM

.

Subject: A quick note from Peter!

.

Kent,

.

Following my name below is the brief note I got from Peter in

response to me sending him your note with your questions for

him. He’s pressed for time and so may have more to say later.

You might also wish to give me more specific information, commentary,

analysis, opinions, whatever from you to forward to him for further

consideration. He will have to work through the details as he gets

time, not knowing right now where the exchange might lead.

.

Also, in relation to Peter’s comments, and your earlier claim of

ignorance regarding your own U.S. Tax Court case, I offer the

following comments from an earlier U.S. Tax Court decision in your case:

.

UNITED STATES TAX COURT

WASHINGTON, DC 20217

.

KENT HOVIND,

Petitioner,

.

v. Docket No. 4245-10.

.

COMMISSIONER OF INTERNAL REVENUE,

Respondent

.

O R D E R

.

(excerpts)

.

the Court notes that the record in this case

is replete with patently frivolous and groundless

arguments by petitioner, acting by and through

his counsel, Mr. Jerold W. Barringer.

.

Petitioner is advised that I.R.C. section 6673(a)

(1) authorizes the Tax Court to require a taxpayer

to pay to the United States a penalty of up to

$25,000 whenever it appears that proceedings have

been instituted or maintained by the taxpayer

primarily for delay or that the taxpayer’s

position in such proceedings is frivolous or

groundless.

.

(Signed) John O. Colvin

ChiefJudge

Dated: Washington, D.C.

.

September 20, 2010

.

– END EXCERPTS –

.

Sincerely,

Robert Baty

.

From: peterreillycpa@gmail.com

To: rlbaty@webtv.net

Date: Sat, 26 Jan 2013 22:01:09 -0500

.

Subject: Re: Kent wants you to answer some questions first!

.

Basically someone who puts forth arguments

that they are not required to file or pay

that have consistently been found to be

frivolous.

.

For example the 16th amendment not having

been ratified.

.

(10)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/26/2013 11:11:36 PM

.

Subject: RE: U.S. Tax Court Issues.

.

Thanks.

.

As I said, I’ve not heard from them or

Jerry Barringer or been served anything

in several years.

.

KH

.

(11)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/26/2013 11:13:01 PM

.

Subject: RE: U.S. Tax Court Issues

.

I can’t get on the internet here but

would love to see the recent ruling

in my wife’s case.

.

Can you send that please?

.

Thanks,

KH

(12)

.

From: Robert Baty

To: Kent Hovind

Date/Time: 1/26/2013 11:22:01 PM

.

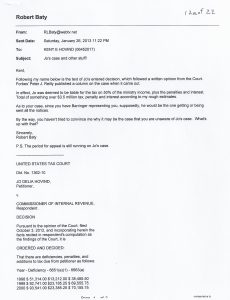

Subject: Jo’s case and other stuff!

.

Kent,

.

Following my name below is the text of Jo’s entered decision,

which followed a written opinion from the Court. Forbes’

Peter J. Reilly published a column on the case when it came out.

.

In effect, Jo was deemed to be liable for the tax on 50% of the

ministry income, plus the penalties and interest. Total of

something over $3.5 million tax, penalty and interest according

to my rough estimates.

.

As to your case, since you have Barringer representing you,

supposedly, he would be the one getting or being sent all the

notices.

.

By the way, you haven’t tried to convince me why it may be

the case that you are unaware of Jo’s case. What’s up with that?

.

Sincerely,

Robert Baty

.

P.S. The period for appeal is still running on Jo’s case.

.

UNITED STATES TAX COURT

.

Dkt. No. 1362-10

.

JO DELIA HOVIND,

Petitioner,

.

v.

.

COMMISSIONER OF INTERNAL REVENUE,

Respondent .

.

DECISION

.

Pursuant to the opinion of the Court. filed

October 3, 2012, and incorporating herein the

facts recited in respondent’s computation as

the findings of the Court, it is

.

ORDERED AND DECIDED:

.

That there are deficiencies, penalties, and

additions to tax due from petitioner as follows:

.

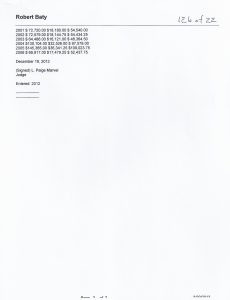

Year – Deficiency – 6651(a)(1) – 6663(a)

.

1998 $ 51,314.00 $13,212.00 $ 38,485.50

1999 $ 92,741.00 $23,185.25 $ 69,555.75

2000 $ 93,541.00 $23,385.25 $ 70,155.75

2001 $ 72,720.00 $18,180.00 $ 54,540.00

2002 $ 72,579.00 $18,144.75 $ 54,434.25

2003 $ 64,486.00 $16,121.00 $ 48,364.50

2004 $130,104.00 $32,526.00 $ 97,578.00

2005 $145,365.00 $36,341.25 $109,023.75

2006 $ 69,917.00 $17,479.25 $ 52,437.75

.

December 18, 2012

.

(Signed) L. Paige Marvel

Judge

.

Entered: 2012

.

(13)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/27/2013 10:04:11 AM

.

Subject: RE: A review of those documents you mentioned!

.

“tried and found wanting…?

.

judiciary decides questions of law…

.

didn’t work…

.

Does that prove guilt?

Does it prove a law was broken?

Could it be corruption from the courts?

The gov?

Do courts and judges ever make mistakes?

Misread or misapply the law?

Why is there an appeals process?

Why are there Appeals courts?

Do cases ever get overturned on appeal?

.

The US Supreme Court-supposedly the top judges in

the country very often spits 5/4 and rarely votes

100%.

.

What would that mean about reading the law?

.

Through history there have been scores of cases

where the courts ruled one way that history later

showed to be 100% wrong.

.

Slavery in US, Hitler’s judges ruling on Jews,

Stalin’s on Christians etc.

.

I think you may be assuming more of our court

system in this case than you should.

.

Gotta go now-

more later if time permits.

.

KJ

.

(14)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/27/2013 11:32:34 AM

.

Subject: RE: A review of those documents you mentioned!

.

Time for one more quick comment only–

.

The banker was a good friend I met in prison.

.

He chose to remain anonymous until he was released.

.

I don’t know where he is now or if he has commented

to identify himself.

.

His name doesn’t matter but the issues do.

.

The 45 counts I was charged with are flawed for a number

of reasons spelled out in document 335, 349 and 351 in my

case.

.

If the charge in the indictment is wrong the court lacks

jurisdiction to hear the case.

.

It is NEVER too late to challenge jurisdiction.

This is NOT over yet. 🙂

.

Since there are still issues being litigated I cannot

comment much but I will continue on this one topic only

if you will answer a few simple questions first.

.

1.

.

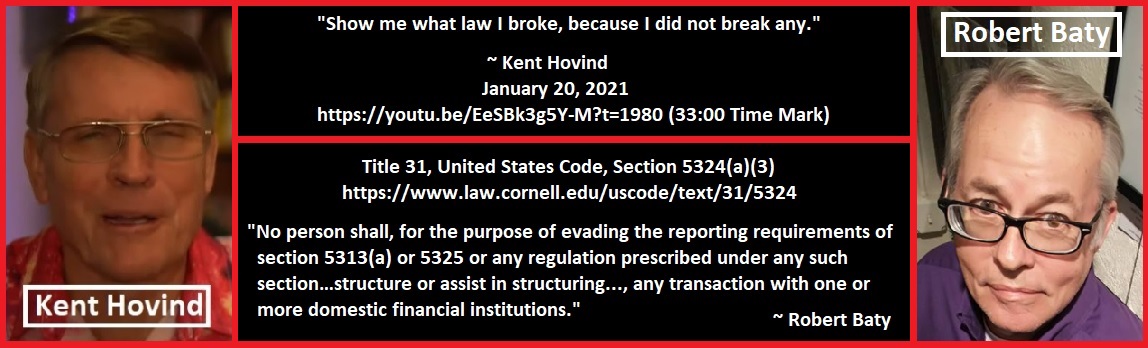

Did I break the law Title 31 USC 5313(A),

5324 (a)(3) and 31 CRF 103.11?

.

I’m not asking if the court found me guilty.

.

Can you please read the above referenced documents

and the banker’s letter and show me specifically

what I did that was illegal?

.

2.

.

IF withdrawing ministry money to pay ministry bills

in amounts less than $10,000, 12 days apart did

violate that law- should it have been one count or 45?

.

Thanks,

KH

.

(15)

,

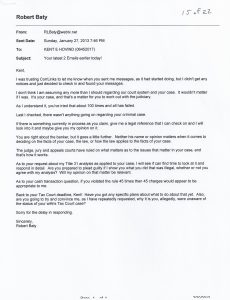

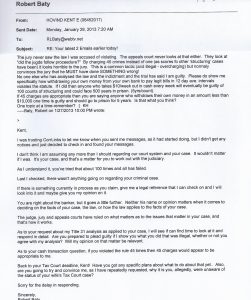

From: Robert Baty

To: Kent Hovind

Date/Time: 1/27/2013 7:46:33 PM

,

Subject: Your latest 2 Emails earlier today!

,

Kent,

,

I was trusting CorrLinks to let me know when you sent me

messages, as it had started doing, but I didn’t get any

notices and just decided to check in and found your messages.

,

I don’t think I am assuming any more than I should regarding

our court system and your case. It wouldn’t matter if I was.

It’s your case, and that’s a matter for you to work out with the judiciary.

,

As I understand it, you’ve tried that about 100 times and all has failed.

,

Last I checked, there wasn’t anything going on regarding your

criminal case.

,

If there is something currently in process as you claim, give me a

legal reference that I can check on and I will look into it and maybe

give you my opinion on it.

,

You are right about the banker, but it goes a little further.

Neither his name or opinion matters when it comes to deciding

on the facts of your case, the law, or how the law applies to the

facts of your case.

,

The judge, jury and appeals courts have ruled on what matters as

to the issues that matter in your case, and that’s how it works.

,

As to your request about my Title 31 analysis as applied to your

case, I will see if can find time to look at it and respond in detail.

Are you prepared to plead guilty if I show you what you did that

was illegal, whether or not you agree with my analysis? Will my

opinion on that matter be relevant.

,

As to your cash transaction question, if you violated the rule 45

times then 45 charges would appear to be appropriate to me.

,

Back to your Tax Court deadline, Kent! Have you got any specific

plans about what to do about that yet. Also, are you going to try

and convince me, as I have repeatedly requested, why it is you,

allegedly, were unaware of the status of your wife’s Tax Court case?

,

Sorry for the delay in responding.

,

Sincerely,

Robert Baty

,

(16)

,

From: Robert Baty

To: Kent Hovind

Time/Date: 1/27/2013 8:47:22 PM

,

Subject: The banker’s letter and structuring rules!

,

Kent,

,

Let me expand a little on your banker problem before

responding on the structuring issue.

,

Your anonymous banker proposes to tell me how things

are/were and promotes himself as if he is qualified and

credible regarding his promotion of the alleged facts and

law and should be given some consideration. Interesting

how the letter does not appear to mention that he is a

convicted felon and the charges for which he was convicted.

,

Ad hominem is not fallacious when proposing that, in such

situations, such witnesses’ credibility may be reasonably

doubted both as to the factual claims and legal analysis.

,

Kent, you wrote in part, asking:

,

> Can you please read the referenced

> documents and the banker’s letter

> and show me specifically what I

> did that was illegal?.

I don’t like chasing rabbits, so you really need to get down

to what you are getting at, with specifics, if you have a point

you want to make. I don’t like guessing at what you might

want me to get out of such references.

.

I like short, sweet, and to the point.

.

In this case, however, I will give it a shot.

.

The references, in part, follow my name below. This analysis

is subject to a further review of your case as I might get the

time and have the interest or some additional, specific, explicit,

feedback from you.

.

Your Question:

.

> WHAT DID KENT HOVIND DO THAT WAS ILLEGAL?

.

My Answer, from attached references:

.

> Structured financial transactions to

> evade financial reporting rules.

>

> Such structuring does not require a

> transaction of more than $10,000..

I claim no expertise in that area, so if there is some specific

you are getting at, Kent, let me know.

.

Sincerely,

Robert Baty

.

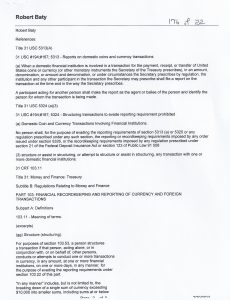

References:

.

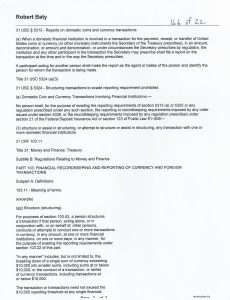

Title 31 USC 5313(A)

.

31 USC § 5313 – Reports on domestic coins and currency transactions

.

(a) When a domestic financial institution is involved in a transaction

for the payment, receipt, or transfer of United States coins or currency

(or other monetary instruments the Secretary of the Treasury prescribes),

in an amount, denomination, or amount and denomination, or under

circumstances the Secretary prescribes by regulation, the institution

and any other participant in the transaction the Secretary may prescribe

shall file a report on the transaction at the time and in the way the

Secretary prescribes.

.

A participant acting for another person shall make the report as the

agent or bailee of the person and identify the person for whom the

transaction is being made.

.

Title 31 USC 5324 (a)(3)

.

31 USC § 5324 – Structuring transactions to evade reporting requirement

prohibited

.

(a) Domestic Coin and Currency Transactions Involving Financial Institutions.

.

No person shall, for the purpose of evading the reporting requirements

of section 5313 (a) or 5325 or any regulation prescribed under any such

section, the reporting or recordkeeping requirements imposed by any

order issued under section 5326, or the recordkeeping requirements

imposed by any regulation prescribed under section 21 of the Federal

Deposit Insurance Act or section 123 of Public Law 91508

.

(3) structure or assist in structuring, or attempt to structure or assist

in structuring, any transaction with one or more domestic financial institutions.

.

31 CRF 103.11

.

Title 31: Money and Finance: Treasury

.

Subtitle B: Regulations Relating to Money and Finance

.

PART 103: FINANCIAL RECORDKEEPING AND REPORTING

OF CURRENCY AND FOREIGN TRANSACTIONS

.

Subpart A: Definitions

.

103.11 – Meaning of terms.

.

(excerpts)

.

(gg) Structure (structuring).

.

For purposes of section 103.53, a person structures

a transaction if that person, acting alone, or in

conjunction with, or on behalf of, other persons,

conducts or attempts to conduct one or more transactions

in currency, in any amount, at one or more financial

institutions, on one or more days, in any manner, for

the purpose of evading the reporting requirements under

section 103.22 of this part.

.

“In any manner” includes, but is not limited to, the

breaking down of a single sum of currency exceeding

$10,000 into smaller sums, including sums at or below

$10,000, or the conduct of a transaction, or series

of currency transactions, including transactions at

or below $10,000.

.

The transaction or transactions need not exceed the

$10,000 reporting threshold at any single financial

institution on any single day in order to constitute

structuring within the meaning of this definition.

.

(17)

.

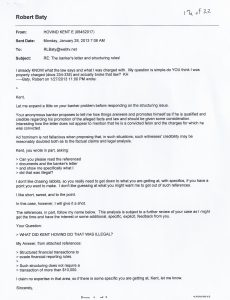

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/28/2013 7:06:10 AM

.

Subject: RE: The banker’s letter and structuring rules!

.

I already KNOW what the law says and what

I was charged with.

.

My question is simple-do YOU think I was properly

charged (docs 334-338) and actually broke that law?

.

KH

.

(18)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/28/2013 7:20:54 AM

.

Subject: RE: Your latest 2 Emails earlier today!

.

The jury never saw the law I was accused of violating.

.

The appeals court never looks at that either.

.

They look at “did the jugde follow proceedure?”

.

By charging 45 crimes instead of one (as scores fo

other ‘structuring’ cases have been) it looks horrible

to the jury.

.

This is a common tactic (and illegal – overcharging)

but normaly convinces the jury that he MUST have done

SOMETHING wrong!

.

No one else who has analysed the law and the indictment

and the trial has said I am guilty.

.

Please do show me specifically how withdrawing your

own money from your own bank to pay legit bills in

12 day ave. intervals violates the statute.

.

If I did then anyone who takes $10/week out in cash

every week will eventually be guilty of 100 counts of

structuring and could face 500 years in prison. (5yrs/count).

.

If 45 charges are appropriate then you are saying anyone

who withdraws their own money in an amount less than

$10,000 one time is guilty and should go to prison for

5 years.

.

Is that what you think?

One topic at a time-remember? 🙂

.

KH

.

(19)

.

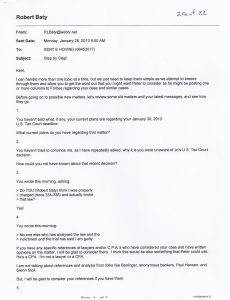

From: Robert Baty

To: Kent Hovind

Date/Time: 1/28/2013 8:50:28 AM

.

Subject: Step by Step!

.

Kent,

.

I can handle more than one topic at a time, but we just

need to keep them simple as we attempt to breeze through

them and allow you to get the word out that you might want

Peter to consider as he might be posting one or more columns

to Forbes regarding your case and similar cases.

.

Before going on to possible new matters, let’s review some

old matters and your latest messages, and see how they go.

.

1.

.

You haven’t said what, if any, your current plans are regarding

your January 30, 2013 U.S. Tax Court deadline.

.

What current plans do you have regarding that matter?

.

2.

.

You haven’t tried to convince me, as I have repeatedly asked,

why it is you were unaware of Jo’s U.S. Tax Court decision.

.

How could you not have known about that recent decision?

.

3.

.

You wrote this morning, asking:

.

> Do YOU (Robert Baty) think I was properly

> charged (docs 334-338) and actually broke

> that law?.

Yes!

.

4.

.

You wrote this morning:

.

> No one else who has analysed the law and the

> indictment and the trial has said I am guilty..

If you have any specific references of lawyers and/or

C.P.A.’s who have considered your case and have written

opinions on the matter, I will be glad to consider them.

I think this would be also something that Peter could use.

.

He’s a CPA.

I’m not a lawyer or a CPA.

.

I am not talking about references and analysis from folks

like Barringer, anonymous bankers, Paul Hansen, and Glenn Stoll.

.

But, I will be glad to consider your references if you have them.

.

5.

.

> If 45 charges are appropriate then you are

> saying anyone who withdraws their own money

> in an amount less than $10,000 one time is

> guilty and should go to prison for 5 years.

>

> Is that what you think?.

Your claim about what I am saying is not correct.

No, that is not what I am saying.

.

The crime of structuring has to do with your effort to

evade the reporting requirements of financial institutions.

.

In part, as I understand the application of the law,

it has to do with intent; a frame of mind.

.

The jury doesn’t read minds, but is called upon to look

at the evidence in a case and make their judgment as

to whether or not you were evading the reporting rules.

.

I think we know what the jury decided.

.

They thought your case was so egregious that you got

the enhanced 10 year sentence.

.

6.

.

KENT, YOU DID NOT PUT ON A DEFENSE IN YOUR CRIMINAL CASE!

.

7.

.

KENT, YOU’VE HAD YEARS TO PROSECUTE YOUR APPEALS AND HAVE DONE SO!

.

8.

.

You are welcome to keep trying to change a result in your

criminal case, and it is unlikely that my casual opinions about

the case are going to change the outcome. I am open to

considering a change in my opinion, and you are welcome to

try. Just try to keep it short and simple and specific.

.

9.

.

I get that you don’t seem to think you were properly charged

as to the law violated and that one violation of the misapplied

law should have been all that was allowed.

.

10.

.

Now, are there other matters to consider, and do I start getting

answers to my questions?

.

We can continue to explore further your criminal case details if

you wish.

.

I am here as the go-between in an effort to facilitate your effort

to inform and enlighten Peter J. Reilly as to your case(s) and possibly

publish one or more columns explaining your situation and opining thereon.

.

Sincerely,

Robert Baty

.

(20)

.

From: KENT E HOVIND (06452017)

To: Robert Baty

Date/Time: 1/28/2013 8:50:45 AM

.

Subject: RE: Your latest 2 Emails earlier today!

.

One more thot on the same topic.

.

If structuring requires TWO or more transactions of

less than $10,000 on the same day (and it does) that

total MORE than $10,000 how can there be 45 counts

in my indictment?

.

The MAX would be 22 counts.

.

The indictment is fatally flawed therefore the court

lack jurisdiction to even hear the case.

.

The indictment must still be dismissed and the case

overturned.

.

Are you seeking for truth or seeking to get me to

confess to a crime I (and scores of others) do not

think I committed?

.

What is your motive in all this?

.

You asked if I would admit I was guilty…

.

Will YOU admit I was NOT guilty if that is where the

evidence leads?

.

History records hundreds of thousands of WRONG decisions

that hurt others badly you know.

.

Have a great day! 🙂

.

KH

.

(21)

.

From: Robert Baty

To: Kent Hovind

Date/Time: 1/28/2013 9:06:20 AM

.

Subject: Response to your “one more time” message!

.

Kent,

.

I’ll try to briefly respond to your latest:

.

You wrote:

.

> If structuring requires TWO or more

> transactions of less than $10,000 on

> the same day (and it does)….

.

I don’t think it does.

.

You wrote:

.

> The indictment is fatally flawed therefore

> the court lack jurisdiction to even hear

> the case..

I doubt it, but that is a matter for you to take up on

appeal. I trust the legal system to deal with such

issues and not “laymen”, but I’m open to considering

the matter further if you can keep it simple.

.

You wrote:

> The indictment must still be dismissed

> and the case overturned..

I don’t think so, but we’ll see how that position works out for you.

.

You wrote:

.

> Are you seeking for truth or seeking to

> get me to confess to a crime I (and scores

> of others) do not think I committed?.

I will follow the search for the truth wherever it may lead us,

with or without any confessions or change of minds.

.

You wrote:

.

> What is your motive in all this?

.

To act as the go-between as to you and Peter, as I explained

in my last message. Otherwise, you and your cases have been

of interest to me for years and so I am personally interested in

this further personal dialogue.

.

Peter is rather busy, and I will forward to you any specific

commentary he may have, and his questions whenever he may

be able to present them for you.

.

You wrote:

.

> Will YOU admit I was NOT guilty if

> that is where the evidence leads?.

The judicial process provides for a determination of guilt “in the

eyes of the law”, but you are welcome to my opinion.

.

For all I know, you were guilty.

.

Now, what about those questions I have been asking?

.

Sincerely,

Robert Baty

.

(22)

.

From: admin@inmatemessage.com

To: Robert Baty

Date: Mon, 28 Jan 2013 11:04:29 -0600

.

Subject: Inmate: HOVIND, KENT E

.

The above-named inmate has chosen to

remove your email address from his/her

approved contact list and, therefore,

can not receive or send messages to

your email address.

.

Update November 29, 2019

Because Kent’s Tax Court case was resolved without trial or “opinion”, one should consider the opinion in the Jo Hovind case for some details as to what was going on with all of that.

File containing Jo Hovind’s Tax Court opinion:

Jo Hovind Tax Court Opinion 2012

Update October 31, 2021

The more complete e-mail images!

.

Silly Hovind. He can’t climb through his own well documented lies and crimes.