Watch for Updates

.

About 10 years ago I recommended to Annie Gaylor of the Freedom From Religion Foundation (FFRF) that she, the FFRF, take up where Erwin Chemerinsky left off and legally challenge the constitutionality of Internal Revenue Code Section (IRC) 107 that allows ONLY “ministers” income tax free housing benefits.

The FFRF did take up that effort.

In the most recent action, Judge Crabb of the Federal District Court of Wisconsin ruled that IRC 107(2) is UNconstitutional.

Notice of appeal was filed last week by some intervenors being represented by Becket, a religious, legal activist organization.

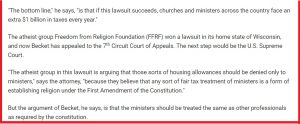

In a brief article today, February 12, 2018, One News Now reported that Becket’s Luke Goodrich made the following statement:

“This law applies not just to ministers but to lots of other professionals, and this lawsuit is an attack by an atheist group trying to take away housing allowances only for ministers.”

I believe that statement to be false; a lie if you will.

I figure anyone familiar with the law, as Mr. Goodrich should be, should know that, in fact, IRC 107 ONLY applies to “ministers” and that everyone else has to comply with more restrictive tax benefits allowed for housing without regard to the invocation of “minister” status.

I have written to Becket and to One News Now for a response to my claim. I will try to update this page if responses are received.

Related links:

https://www.onenewsnow.com/legal-courts/2018/02/12/becket-no-pastors-arent-privileged-just-equal

.

.

https://www.law.cornell.edu/uscode/text/26/107

.

https://www.facebook.com/FFRF-v-US-IRC-107-Challenge-212102828961960/

.

.

Images:

.

.

.

.

In the earlier Wisconsin case in which Judge Crabb ruled that IRC 107(2) was UNconstitutional, there was a deposition of Annie Gaylor. Following are excerpts from that deposition which bears on my opening comments above.

.

Deposition of Annie Laurie Gaylor

Filed with the Court 06/28/2013

.

Milwaukee, WI

April 23, 2013

1:20 – 3:35 PM

.

Examination

By Ms. Healy Gallagher

.

(excerpts – page 61ff)

.

Ms. Gallagher’s Question:

.

Have you ever heard anything about an IRS

examination under Section 107?

.

Ms. Gaylor’s Answer:

.

…And, you know, I’ve come into contact

with, you know, allegations of abuse of

the tax, of the IRS.

.

Ms. Gallagher’s Question:

.

What do you mean when you say, come into

contact with?

.

Ms. Gaylor’s Answer:

.

Well, I’ve seen some write-ups about, you

know, these coaches that were being given

the parish exemption, for example.

.

There was a case involving a school.

.

Ms. Gallagher’s Question:

.

Any information not come from the media?

.

Ms. Gaylor’s Answer:

.

I guess–I am trying to remember.

.

I think that somebody–you know, I was given

a case to look at that wouldn’t have come

from a member of the media, but from an

individual.

.

Ms. Gallagher’s Question:

.

Who was that individual?

.

Ms. Gaylor’s Answer:

.

Do I have to answer that question?

.

Rich Bolton (FFRF Lawyer):

.

Who gave you the particular case?

.

Ms. Gaylor’s Answer:

.

Yeah. Because I feel my source was

confidential.

.

Ms. Gallagher:

.

Unless your attorney is instructing you

not to answer, you have to answer.

.

Rich Bolton (FFRF Lawyer):

.

There’s not really a ground for not

answering the question, so if you can answer.

.

Ms. Gaylor’s Answer:

.

Okay. All right. Well, I mean, I felt this

information was confidential, who gave me

the information was confidential, not the

information. Robert Baty.

.

Ms. Gallagher:

.

Uh-huhh. Uh-huhh.

.

Rich Bolton (FFRF Lawyer):

.

He’s not exactly been under the radar. I

don’t know if you know Mr. Baty or not.

.

Ms. Gallagher:

.

I’m familiar with the name.

.

Rich Bolton (FFRF Lawyer):

.

Yeah, I don’t think you are giving away

any secrets with Bob’s name.

.

Ms. Gallagher’s Question:

.

So, tell me about your conversations with

Mr. Baty.

.

Ms. Gaylor’s Answer:

.

I don’t think I’ve really–I’ve conversed

with him, it’s very rarely. I think it

was mostly just by emails.

.

Ms. Gallagher’s Question:

.

And what kind of emails have you had with

him?

.

Ms. Gaylor’s Answer:

.

Well, that he thinks this is unconstitutional.

.

Ms. Gallagher’s Question:

.

How often do you email with Mr. Baty?

.

Ms. Gaylor’s Answer:

.

Very rarely. I don’t know. I think I may

have heard from him once in the last year

or recently.

.

There was a time when I was receiving more

information from him.

.

Ms. Gallagher’s Question:

.

When was that?

.

Ms. Gaylor’s Answer:

.

Oh, at the time, before we filed out case

in–the franchise board case.

.

Ms. Gallagher’s Question:

.

So, was Mr. Baty one of the motivating

factors to file the lawsuit about the

107 exemption?

.

Ms. Gaylor’s Answer:

.

Well, he gave information that was helpful.

.

Ms. Gallagher:

.

I may end up asking for those e-mails just

in terms of document productions in the future.

.

.

How It All Started

.

From: Annie Laurie Gaylor

To: Robert Baty

Sent: Sunday, November 30, 2008 4:11 PM

.

Subject: Re: Challenging IRC 107; ministerial housing allowances!

Sent: Sunday, November 30, 2008 4:11 PM

.

Subject: Re: Challenging IRC 107; ministerial housing allowances!

.

Thank you for your intriguing e-mail.

.

My question would be: who would have standing to sue, since the Hein v FFRF ruling?

.

It would have to be in federal court, since it’s a federal law, if I understand this correctly, and if federal taxpayers would not be able to pursue it, who would be an injured party? I could possibly see a neighbor of a “rectory” who might be able to prove they paid more taxes when the “rectory” went off the tax rolls? But such a plaintiff might be very hard to find.

.

I can pass on to our attorneys but a little more information on how you would see this lawsuit proceeding would be most appreciated.

.

Annie Laurie Gaylor

Co-President

Freedom From Religion Foundation

PO Box 750

Madison WI 53701

608/256-5800

.

On Nov 26, 2008, at 10:33 PM, Robert Baty wrote:

.

Some have long held the position that IRC 107, the tax law allowing “ministers” to receive housing allowances tax free, is UNconstitutional.

.

However, to my knowledge, there has not been an appropriate challenge to test the theory.

.

Erwin Chemerinksy, as amicus in the Rick Warren case, had indicated that he was intending to mount a legal challenge to IRC 107.

.

Chemerinsky recently advised me that, while the project was worthwhile, he no longer had the time to puruse it.

.

So, I’m wondering if your organization might take up the project or be able to recommend an organization or individual that would.

.

I would like to see the project pursued.

.

Any attention you are able to give to the matter and this inquiry will be greatly appreciated.

.

Sincerely,

Robert Baty

IRS Appeals Officer, retired

.

Update February 16, 2018 – Latest from Forbes.com

.

(Excerpt)

.

Bane Of The Basketball Ministers

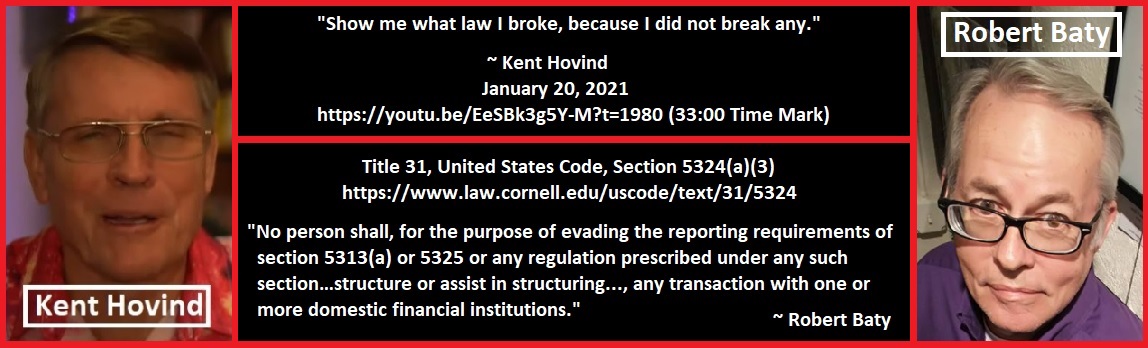

First up is retired IRS appeals officer Robert Baty, Kent Hovind’s worst nightmare and bane of the basketball ministers. Bob included something on the Becket release on his website – Kent Hovind v. Robert Baty – The Great Debates! He uses the measured title – “Is Luke Goodrich of Becket Lying?”

.

Comments

Is Luke Goodrich of Becket Lying? — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>