Watch for Updates

Originally Posted February 11, 2018

by Robert Baty

Excerpts from:

http://www.quatloos.com/hereisthelaw.htm

.

CONSTITUTIONALITY

.

Article I, Section 8

.

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises . . . but all Duties, Imposts and Excises shall be uniform throughout the United States.

.

Article I, Section 8

.

To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.

.

Article I, Section 9

.

No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census of Enumeration herein before directed to be taken.

.

Amendment XVI

.

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

.

Commentary – Constitutionality

.

The bottom line is that challenges to the income tax based on the Constitution are bogus, and demonstrably so.

.

THE LAW

.

THE LAW that makes the average American liable to pay income taxes is in Section 1 of the Internal Revenue Code, 26 U.S.C. § 1. Congress put THE LAW right up front so that nobody could miss it (well, nobody who was actually interested in knowing, anyhow).

.

Section 1. Tax Imposed

There is hereby imposed on the taxable income of [various categories, such as married individuals, single individuals, etc., omitted for sake of this discussion] a tax determined in accordance with the following table: [table omitted for brevity].

.

Section 61. Gross Income Defined

.

(a) General definition – Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items:

.

(1) Compensation for services, including fees, commissions, fringe benefits, and similar items;

.

(2) Gross income derived from business;

.

(3) Gains derived from dealings in property;

.

(4) Interest;

.

(5) Rents;

.

(6) Royalties;

.

(7) Dividends;

.

(8) Alimony and separate maintenance payments;

.

(9) Annuities;

.

(10) Income from life insurance and endowment contracts;

.

(11) Pensions;

.

(12) Income from discharge of indebtedness;

.

(13) Distributive share of partnership gross income;

.

(14) Income in respect of a decedent; and

.

(15) Income from an interest in an estate or trust.

.

Section 63. Taxable Income Defined

.

(a) In general – [T]he term “taxable income” means gross income minus the deductions allowed by this chapter (other than the standard deduction).

.

Commentary – The Law

.

It is that simple! This is why no accredited legal or tax scholar worldwide thinks that the bogus theory “that there is no law making the average American liable for the payment of income taxes” is anymore than a bad joke.

.

The Scam Artists and Reality Deniers have for decades tried to get any legal or tax scholar interested in their kooky reasons for not paying taxes, but none have bitten.

.

It is also the reason that ALL the courts in the United States, included the United States Supreme Court, have routinely characterized tax protestors’ arguments as frivolous, and have hit tax protestors with huge penalties up to $25,000 for making their stupid arguments.

.

All the courts in the United States have also routinely affirmed the convictions of tax protestors (a very small handful have won acquittals in their criminal trials, by convincing the jury that they were too stupid to understand that they had to pay taxes – all those tax protestors remained 100% liable to pay their taxes).

.

No tax protestor has ever won a court case to avoid their income taxes, never. It is not because of any kookie conspiracy theories; it is simply because tax protestors are WRONG.

.

.

.

.

Update January 10, 2020

The Law That Says We Have to Pay Federal Income Tax!

https://taxfoundation.org/must-pay-federal-income-tax/

(excerpt)

“(U)ltimately the truth is that

the Secretary of State proclaimed the ratification of the Sixteenth Amendment on February 25, 1913,

26 U.S.C. § 1 imposes tax on taxable income,

26 U.S.C. § 63 defines taxable income as gross income minus allowed deductions,

26 U.S.C. § 61 defines gross income as all income from whatever source derived,

and

26 U.S.C. § 6012 requires the filing of returns by every individual with gross income for the year (with some exceptions).”

Update March 24, 2022

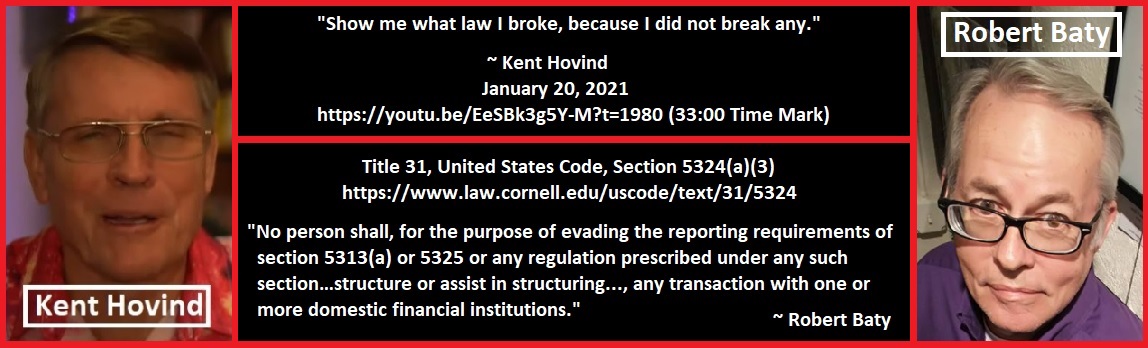

Kent Hovind U.S. Tax Court Docket Record

Kent Hovind Tax Court Docket Record

.

Comments

“Show me the law!” – OK! – Income Tax 101 — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>