Watch for Updates

Originally Posted September 18, 2016

by Robert Baty

https://www.facebook.com/photo.php?fbid=1050558325875225&set=pb.100027632027413.-2207520000.&type=3

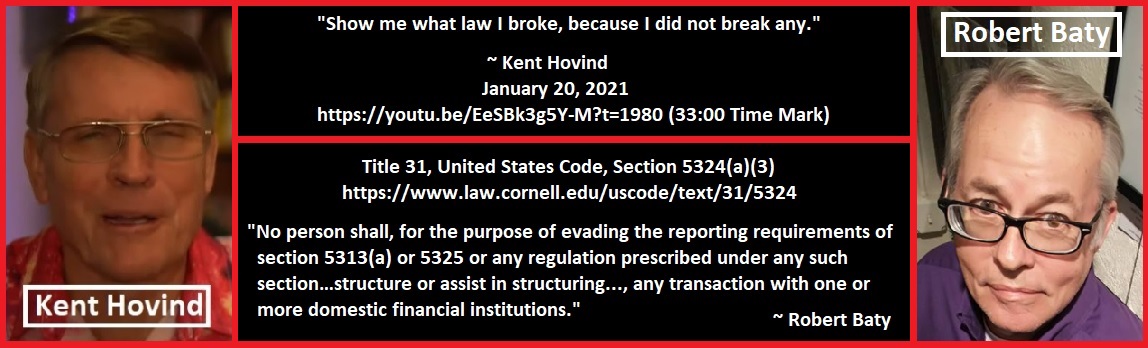

As many of us know, Kent Hovind does not like to take responsibility for much of anything, and Glen Stoll has been one of his “go-to” guys whose counsel he reasonably, allegedly, relied upon to try and cover his criminal activities.

This page is a work in progress in that I do not presently have the latest, up to date information on Glen Stoll’s whereabouts and operations.

Here’s a link to the ORDER providing an injunction against Glen Stoll and Michael Stevens and related operations from 2005:

https://www.justice.gov/sites/default/files/tax/legacy/2006/03/08/Stoll_Perm_Inj.pdf

Here’s a link to a news account of what is behind the above injunction:

http://www.seattlepi.com/local/article/Two-Snohomish-County-men-accused-of-anti-tax-1166623.php

Forbes.com contributor Peter J. Reilly discussed the Hovind-Stoll connection in the following article:

.http://www.forbes.com/sites/peterjreilly/2015/01/13/looking-at-kent-hovinds-innocence-claims/#2372eb834996

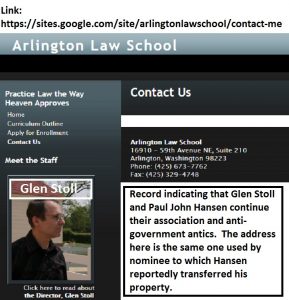

Since that time it appears that Glen Stoll put together something he called the Arlington Law School, with an Internet address shown below:

https://sites.google.com/site/arlingtonlawschool/

There’s also a FaceBook page for him at:

https://www.facebook.com/churchcounsel

.

Glen Stoll has been known for his association with the Embassy of Heaven organization as noted in the Wikipedia article below:

https://en.wikipedia.org/wiki/Embassy_of_Heaven

(Begin excerpts.)

The Embassy of Heaven is a Christian-based new religious movement based in Stayton, Oregon that seeks to separate from secular government.

Its members profess to be literal citizens of the Kingdom of Heaven and reject any ties to what they refer to as “worldly governments”.

The organization issues its own identity documents (including passports and drivers licenses), business licenses, motor vehicle title certificates and license plates.

The group’s leader is Craig Douglas Fleshman, a former Oregon state computer systems analyst who goes by the name “Pastor Paul Revere.”

Another individual who has been associated with the organization in the past is GLEN STOLL, an individual who, “falsely hold[s] himself out to be a ‘lawyer’ and claims to have spent considerable time studying the tax laws” but who “is not a member of or licensed with any state or federal bar.”

(End excerpts.)

.

And from those sites we get a couple of pictures:

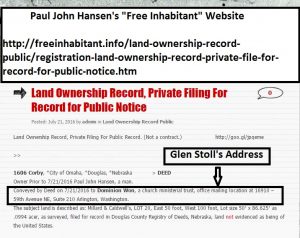

Here’s a couple of more references that tie Stoll to Hansen who is tied to Hovind and Land:

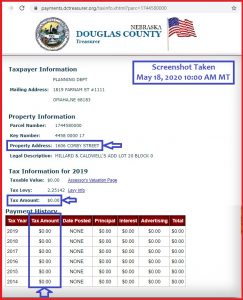

Update May 18, 2020

Looks like the above referenced property in Omaha, NB was taken from Hansen and currently belongs to the City. Seems there was a house on the property that now appears to have been razed; one of Hansen’s slumlord properties.

.

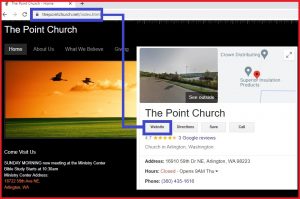

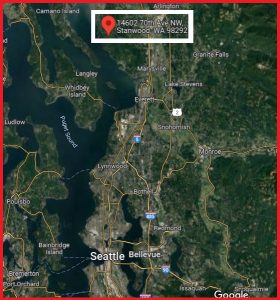

Some pictures of the address in question in Arlington, WA:

.

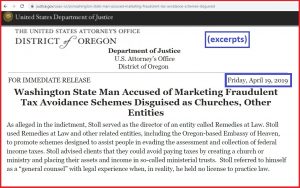

Update November 9, 2019

It seems Glen Stoll has been indicted and is scheduled for trial early in 2020. See Quatloos coverage of the latest at:

http://www.quatloos.com/Q-Forum/viewtopic.php?f=30&t=12045

.

Link to FBI Press Release of April 19, 2019

.

The Glen Stoll Indictment

Glen Stoll Indictment April 2019

.

Update April 27, 2020

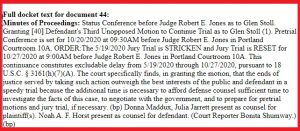

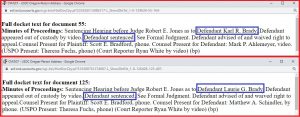

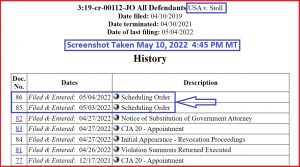

Glen’s criminal docket currently has 44 entries and that entry is as follows:

.

Update May 15, 2020

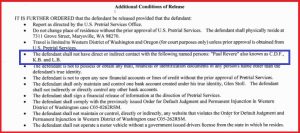

Glen Stoll’s original conditions of release (they have since been modified somewhat):

Glen Stoll Conditions of Release

.

Update May 16, 2020

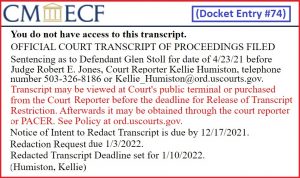

Transcripts of certain proceedings in the Glen Stoll case have now become available and may be found at the following links, with links indicating the nature of the proceeding transcripted.

Stoll Initial Release Issues 06112019

Stoll Release Violation Hearing 06242019

Stoll Status Conf Transcript 12192019

Glen Stoll has always played games with regards to names and addresses. However, in his criminal case it appears he has been compelled to give his legitimate residence where he lives with his wife and as shown in the Google view from 2012 indicated below. Interesting that Google appears to have captured an image of Glen at that residence.

.

Update May 18, 2020

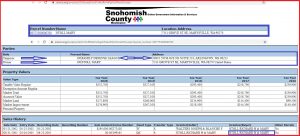

Additional information on residence claimed by Glen Stoll. Note that the “taxpayer”, Family Defense League, is listed at an address the same as the Arlington Law School mentioned earlier in this article and is an address that has been used by both Glen Stoll and Paul John Hansen.

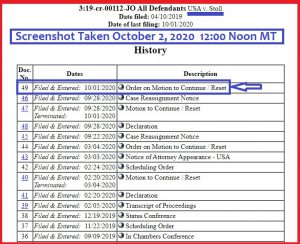

Update October 2, 2020

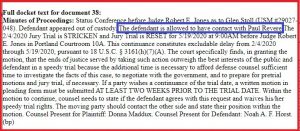

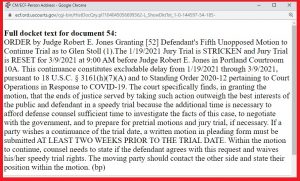

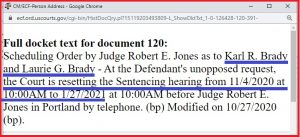

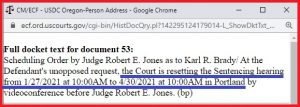

Glen Stoll continues to walk the streets and has asked for another delay in his criminal trial and it has been, again, rescheduled.

Update November 27, 2020

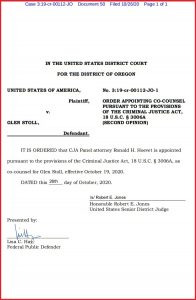

In April of 2019, Glen Stoll was appointed federal public defense counsel in the person of Noah A.F. Horst. Apparently, in preparation for trial early next year, Glen Stoll has been appointed a second federal public defender in the name of Ronald H. Hoevet.

Update December 9, 2020

Glen Stoll allowed his 5th delay!

Glen’s clients who previously pled guilty in the related case recently had their sentencing postponed until next month.

Update January 25, 2021

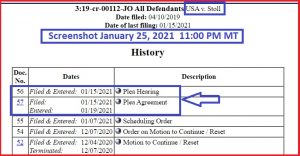

Glen Stoll has entered into a plea agreement and will be sentenced in April 2021. The Bradys, his clients, have obtained another continuance as to their sentencing to April 2021, after Stoll’s sentencing.

Glen Stoll Plea Agreement

Glen Stoll Plea Agreement Letter 01152021

Docket Entry Regarding Plea Agreement

Update January 26, 2021

Plea Agreements for Karl & Laurie Brady who will be sentenced in April 2021 after Glen Stoll is sentenced:

Karl Brady Amended Plea Agreement 10032018

Laurie Brady Plea Agreement 01162018

Update February 1, 2021

Peter J. Reilly publishes this article as a Forbes contributor regarding the Glen Stoll angle to the Hovind story:

(Begin excerpt.)

The best known Glen Stoll client is Kent Hovind, Doctor Dino. Hovind became prominent in the right wing conspiracy media bubble in 2015. Nearing the end of a long prison sentence for tax related crimes which had involved Stoll-created trusts, he was being tried for activity in relation to property seized as a result of his 2006 conviction. In a phone interview with Hovind in January 2015, I asked him if his association with Glen Stoll might have been part of what created his problems.

(End excerpt.)

Update April 26, 2021

Looks like Glen got off with a hand slap!

Probation & Restitution He Will Never Pay!

Glen Stoll Govt Sentencing Memo 04142021

Glen Stoll Sentencing Memo 04202021

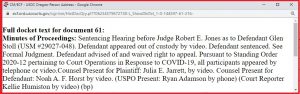

Update April 27, 2021

It is noted that “Document 61” is not available; only the docket entry as noted above. Maybe it will become available later.

Update April 30, 2021

Glen’s clients Karl & Laurie Brady were sentenced today, but I can’t tell what the sentences were. Other co-defendants got similar slaps on the wrist.

News Article – Probation for Both!

(Begin excerpts.)

Oregon City couple sentenced to probation in tax evasion case

An Oregon City couple who shielded more than $3.8 million in income in a tax evasion case was sentenced Friday to three years of probation.

Karl Brady, 59, and wife Laura Brady, 60, failed to pay $1.4 million in taxes from 2008 through 2015, and must pay that amount in restitution.

Karl Brady also pleaded guilty to conspiracy to defraud the United States and conspiracy to commit bank fraud.

The plea agreement called for each of them to plead guilty or the deal was off, according to court records.

Karl Brady was one of three owners of Northwest Behavioral Healthcare Inc., a Gladstone-based residential mental health treatment center for adolescents. The trio concealed income from the center for more than a decade, between 2002 and 2015, according to court documents. Brady served as the company’s vice president of accounting.

The three owners began in 2002 to pay a promoter of an illegal tax scheme to help them hide their income from the Internal Revenue Service. They each paid the promoter about $20,000, according to court documents. Each created other companies and accounts and funneled their money into them.

Co-defendants Daniel Mahler, president and chief executive officer of the mental health care provider, and Lyndon Fischer, vice president of marketing, were sentenced to five years of home detention, allowed out only for work with no luxuries allowed.

In 2007, after the IRS contacted Mahler and Fischer about their failure to file federal income tax returns, the Bradys began using a third promoter of another illegal tax scheme. Under this third scheme, the Bradys formed a purported church, related companies and bank accounts to hide income and assets from the IRS, according to a statement of facts signed by the Brady couple and their lawyers.

Laura Brady’s defense lawyer Matthew Schindler on Friday credited the judge’s intervention in the case for pushing the prosecution to go after the man who preyed on the Bradys and others and duped them into following his scam. Schindler said he also was frustrated that the government demanded a felony conviction for his client, who he said simply “went along with her MBA husband on a scheme to engage in tax fraud.”

“The real criminal here was Glenn Stoll,” Schindler said.

Schindler claimed the prosecutors watched “this scam artist, this tax promoter, stand up and dupe religious people like the Bradys into believing that they could make a church and avoid paying taxes. That man was running around, And the government knew it for years and years and years. And frankly, if it weren’t for this court, he’d still be running around doing that.”

(End excerpts.)

Judgment Document for Glen Stoll

(The separate “Reasons” document was entered but not made public.)

Update May 20, 2021

Amended Judgment

Glen Stoll Amended Judgment 05112021

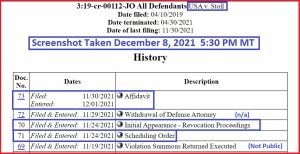

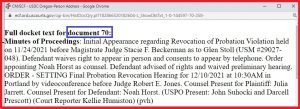

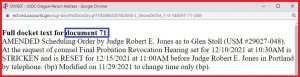

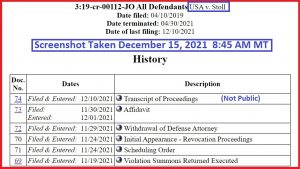

Update December 8, 2021

Attempt to revoke Glen Stoll’s probation!

Update December 9, 2021

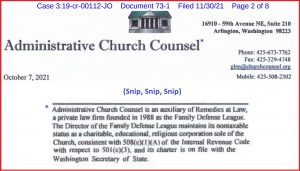

This is from the exhibit noted above filed by Glen Stoll. It indicates that Glen has not changed and is continuing his criminal activity such as he has for decades.

Excerpt from 2019 Press Release on Stoll’s Indictment:

Another website for The Point Church

https://sites.google.com/site/thepointchurch2/about-us

Link to Mike Zachman FaceBook Page

https://www.facebook.com/mike.zachman.7

What appears to be Mike’s wife’s FaceBook page

https://www.facebook.com/laura.frances.1481

Mike Zachman Radio Show

https://www.thepointlive.com/index.html

Update December 15, 2021

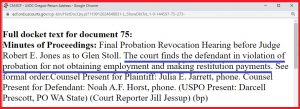

Glen Stoll probation revocation hearing scheduled for later this morning. Meanwhile, his sentencing hearing is not yet publicly available.

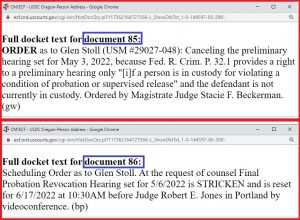

Update May 10, 2022

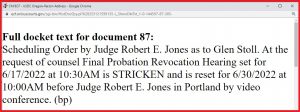

Update June 17, 2022

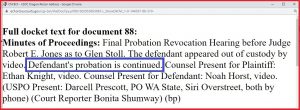

Update June 30, 2022

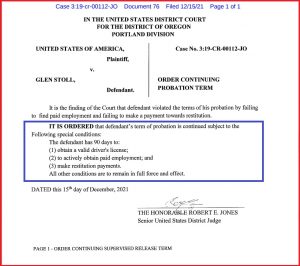

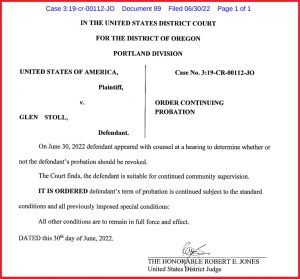

No surprise here; probation continued. Maybe there will be an explanatory ORDER later.

The ORDER

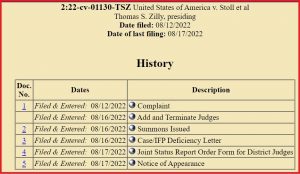

Update August 20, 2022

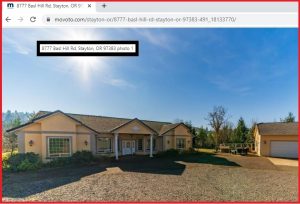

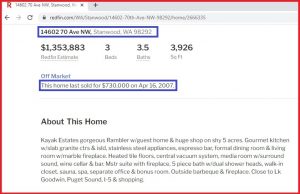

Looks like Glen Stoll has some new legal problems. The feds are after his house!

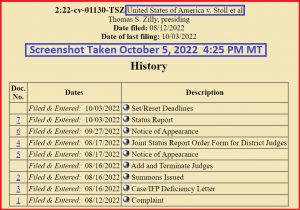

Docket Record as of August 20, 2022

Complaint

USA v. Glen Stoll et al Complaint August 2022

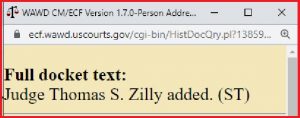

Appointment of Judge

Summonses Issued (4)

Deficiency Letter

Glen Stoll IFP Deficienty Letter

Status Report ORDER

Glen Stoll Status Report Order

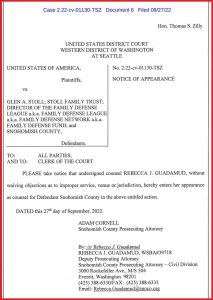

Government Lawyer Cures Deficiency – Files Appearance

Glen Stoll Notice of Appearance by USA Lawyer

Update August 28, 2022

Peter J. Reilly, Forbes contributor, has provided coverage of the latest legal action against Glen Stoll at:

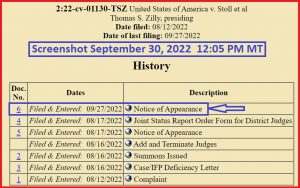

Update September 30, 2022

Lawyer for Snohomish County enters appearance!

Update October 5, 2022

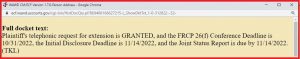

Sounds to me like Glen Stoll is on the run in his federal income tax case. I report. You decide. Maybe they’ll finally “get him”. Maybe not.

Glen Stoll Status Report 10032022

Update October 14, 2022

The feds and Snohomish County work out a deal to protect the county’s interest in the property.

Stipulated Motion in Glen Stoll Tax Case 10142022

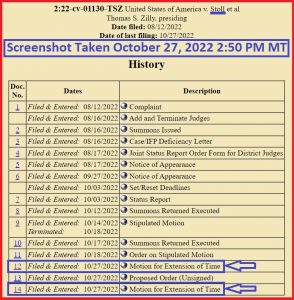

Update October 27, 2022

Looks more and more like Glen Stoll is on the run, evading “service”. Seems to me the feds should be moving to revoke his probation. So, we wait!

Motion for More Time to Serve Glen Stoll

Motion 2 for More Time to Serve Glen Stoll

One of the motions notes that the feds have been in touch with Glen Stoll since October 20, 2022 and have been working to reach an agreement on when he might allow himself to be “served”. Maybe he will. Maybe not.

Update November 7, 2022

Glen Stoll contacts the court in the IRS case and falsely represents his position (in my opinion):

Letter from Glen Stoll on IRS case

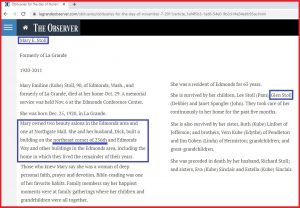

Obituary for Glen’s Mother:

Images of properties Glen mentions in his letter to the Court:

https://www.facebook.com/photo.php?fbid=677169116547483&set=pb.100027632027413.-2207520000.&type=3

.

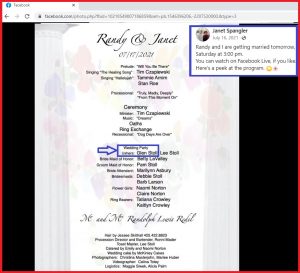

Link to Janet Spangler FaceBook page:

https://www.facebook.com/JanetSpangler.consulting

Janet married in 2021 and Glen Stoll was part of the wedding party!

Seems Glen Stoll may be married!

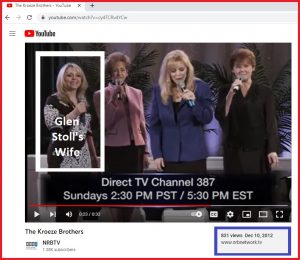

A recent post from his supposed wife’s page!

This makes it clear enough, I guess!

Update November 8, 2022

Looks like Glen Stoll “married” into a family that’s been making a living off religion for decades. I doubt the feds have the time, resources and interest to fully investigate Glen’s extensive criminal enterprise that seems to be continuing.

https://www.youtube.com/watch?v=cy4TCRv4YCw

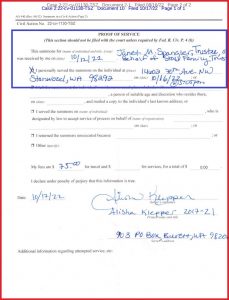

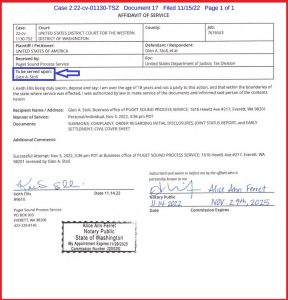

Following is the proof of service as to Janet Spangler. The 21-day response time has passed. Maybe something is pending. Maybe not.

Update November 9, 2022

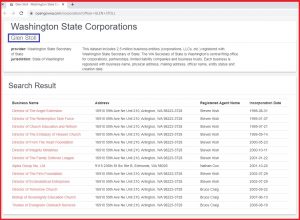

This website purports to reflect the corporations listing Glen Stoll as a director in Washington State.

https://opengovwa.com/corporation?officer=GLEN+STOLL

Update November 9, 2022

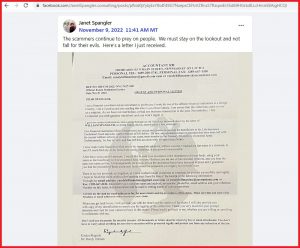

Interestingly, Janet Spangler just posted a new thread on her FaceBook page at the following link complaining of scammers. So, I posted a reply asking about the Glen Stoll case.

(It appears Janet deleted my above post from her thread!)

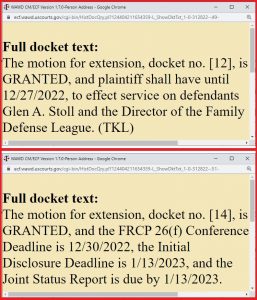

Maybe Janet Spangler will get her ANSWER filed soon. Otherwise, it looks like it’s going to be awhile before anything substantive happens. Here are the last 2 docket entries for the case.

Update November 10, 2022

Link to 2005 article about Glen Stoll criminal activities involving corporations sole and ministerial trusts:

https://www.seattlepi.com/local/article/Two-Snohomish-County-men-accused-of-anti-tax-1166623.php

(Begin excerpts.)

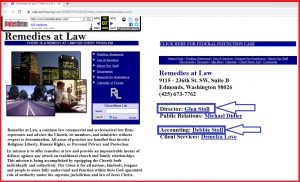

U.S. attorneys filed a lawsuit against Glen Stoll of Edmonds and Michael Stevens of Everett, seeking a permanent injunction against the men’s asset-protection programs.

“The ‘trusts’ that defendants create for their customers are shams, devoid of economic substance,” the lawsuit states.

According to state records, 66 corporations sole are registered at the Edmonds address shared with Stoll’s Remedies at Law.

The government’s lawsuit against Stoll states that the men have created at least 89 corporations sole and at least 47 ministerial trusts.

A federal judge ordered Stoll removed from a courtroom for refusing to follow instructions in answering questions during cross-examination at a 2003 detention hearing at which Stoll was a witness.

(End excerpts.)

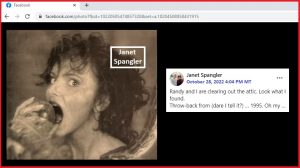

Update November 11, 2022

https://www.facebook.com/photo/?fbid=10160630898631518&set=pcb.10160630898741518

Glen Stoll’s sister Janet Spangler as Eve!

https://www.facebook.com/photo?fbid=10220505474857328&set=a.10204508858431915

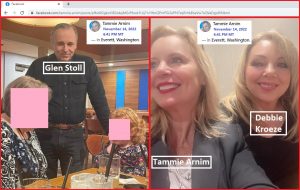

I have been informed that Glen Stoll and Debbie Kroeze have followed the thinking of Kent Hovind and others and are not legally married. This might also make things all the more interesting. It may also be the case that they are no longer living together.

Update November 14, 2022

https://www.janetspanglerconsulting.com/

Janet Spangler YouTube Channel

https://www.youtube.com/c/JanetSpangler

Janet Spangler tribute to Mary Stoll (her mother), with emphasis on privacy!

https://www.youtube.com/watch?v=poUALoawVNk

(At 89 years old, Mary Stoll was still doing taxes for clients, professionally, so says Janet Spangler in the above video. One might wonder if Mary Stoll was a legitimate tax preparer or one of Glen’s brigade of tax cheats.)

Debbie Kroeze YouTube Channel

https://www.youtube.com/channel/UCUgvnVEglKqEKZYTJmQfcQg/videos

(It’s been about a year since video has been posted.)

Debbie Kroeze Website

https://youngerlift.myshopify.com/pages/about

Update November 15, 2022

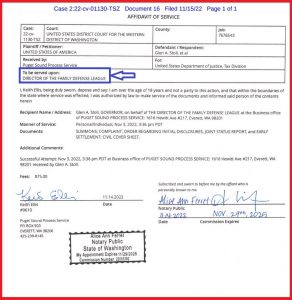

It seems that Glen Stoll and his Family Defense League were “served” on November 3, 2022, but the service was not posted to the docket until today.

From the WayBack Machine:

https://web.archive.org/web/20060707203245/http://www.remediesatlaw.com/

Glen Stoll’s October 15, 2005 “Courtesy Response To Address IRS And Other Concerns”:

Glen & Debbie – 2015

https://www.facebook.com/photo.php?fbid=10153867068396518&set=pb.687576517.-2207520000.&type=3

Update November 16, 2022

Debbie’s sister Tammie had a big to-do a few days ago and it looks like Glen and Debbie both were in attendance; indicating they are still together.

Below is my post to someone who knows Glen and posted a comment under the post of Glen’s picture noted above. Maybe I will get a response. Maybe not.

Update November 28, 2022

Glen Stoll’s game playing begins in the civil suit!

Stoll files Foreign Plea in Abatement

Stoll files Memorandum 11282022

Stoll Affidavit of Service 11282022

Update December 2, 2022

Feds motion for default as to Stoll Family Trust and Family Defense League:

USA motions for default in Stoll case

Update December 4, 2022

Glen Stoll’s old Administrative Church Counsel Website:

https://web.archive.org/web/20190411215502/http://www.churchcounsel.org/

Party Time In Marysville, WA

Update December 8, 2022

USA responds to Stoll’s silliness:

USA response to Stoll Answer to Complaint 12082022

Update December 9, 2022

USA motions for more time!

Update December 19, 2022

The Court appears to be posturing Glen Stoll for default if he doesn’t starting playing along, by the rules.

Minute Entry in USA v. Stoll Civil 12192022

Update December 27, 2022

It begins to drag on …

http://kehvrlb.com/wp-content/uploads/2022/12/Order-in-US-v-Stoll-More-Time-Allowed-12272022.pdf

Update February 3, 2023

Glen Stoll responds to default motion with more foolishness, and the U.S. is right on it with its response to Glen’s response.

Glen’s Response

U.S. Response to Glen’s Response

U.S. Responds to Stoll Response

Update February 16, 2023

Minute Entry Entered – Deadlines Set

Minute Entry Glen Stoll Tax Case 02162023

Update April 4, 2023

It’s going to be awhile!

Stoll Motion by US for More Time

Update April 10, 2023

Glen Stoll’s criminal case gets jurisdiction transfer. I don’t know what this might mean regarding his probation status.

Update April 17, 2023

Glen Stoll Stalling

Update April 21, 2023

Glen Stoll Supplement Filed

Glen Stoll Proposed ORDER/Judgement Proposed

Stoll Proposes Order and Judgement 04212023

US Files Response to Glen Stoll Motion

US Response to Stoll Motion 04212023

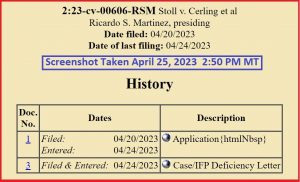

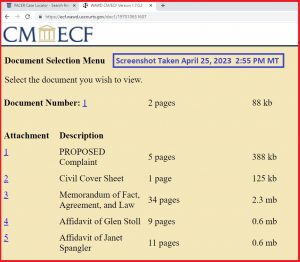

Update April 25, 2023

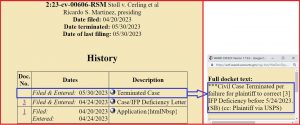

Glen Stoll tries to go after AUSA Dylan Cerling, et al!

Stoll v Cerling Docket Entry 1 Request

Stoll v Cerling Docket Entry 3 Letter to Stoll

Update April 26, 2023

Court denies Stoll request for more time and for dismissal of case.

Court Denies Stoll Request for More Time and Dismissal

Update April 27, 2023

Default Order as to alter-egos. There were some administrative problems and this was not posted until after I looked yesterday.

Stoll Default as to Alter Egos

Update May 25, 2023

Now the feds want more time, and will likely get it; 60 extension requested!

US Motion for More Time 05252023

US Declaration Wanting More Time in Stoll Case 05252023

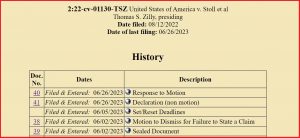

Update June 8, 2023

Stoll Motion to Dismiss 06052023

I suspect the “sealed” document above is the tax return information.

Update June 12, 2023

Effort by Glen Stoll to sue agents terminated for lack of prosecution.

Update June 26, 2023

US Attorney Declaration in US v Stoll Tax Case 06262023

Update August 8, 2023

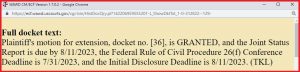

ORDER issued on August 1, 2023

Minute ORDER in Glen Stoll Tax Case 08012023

Update November 10, 2023

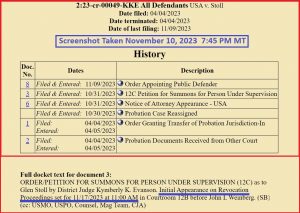

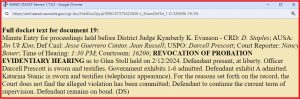

Looks like they are trying again to revoke Glen Stoll’s probation, and it looks like it’s a lot more serious an effort this time; includes a charge of fraud against him.

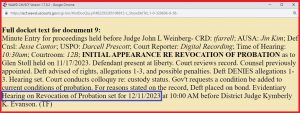

Update November 17, 2023

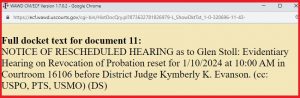

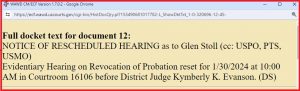

Glen Stoll had a hearing today on the motion for revocation of probation. An evidentiary hearing has been scheduled for December 11, 2023. Glen also had to sign an “Appearance Bond”.

Glen Stoll Appearance Bond 11172023

Update November 30, 2023

Hearing rescheduled; no reason indicated!

Update December 29, 2023

Update February 15, 2024

Looks like Glen Stoll wins another and will now serve out his probation. I think it runs in April 2024.

Update March 8, 2024

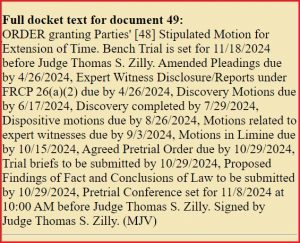

This is the latest scheduling ORDER in the civil case to seize property of Glen Stoll:

.

Comments

Glen Stoll – Hovind, Hansen & Land Legal Scholar, NOT! — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>